Cost plus pricing explained

Cost plus pricing is an easy way to price your goods and services. You simply work out your costs and add a profit markup, I’ll show you how it works.

How many times have your eyes drifted from the services and products on your website to the numbers in your bank account, leaving you with an innate feeling of “what am I doing wrong”? Chances are, you aren’t pricing your packages or goods correctly – and cost plus pricing could be the answer.

Cost plus pricing is one of many pricing models that can help you set prices in a consistent, sustainable and reliable way.

So what is cost plus pricing? Cost plus pricing is the practice of pinpointing the cost of a service or product, and then adding a mark-up to ensure the seller hit a certain rate or profit. It is considered one of the most straightforward pricing methods.

Cost plus pricing is arguably one of the most widespread pricing models; you’ll see it used on anything from a carton of juice to a multimillion-pound development project.

However, as with all processes, it isn’t quite as black and white as that. Here we explain the pros and cons of cost plus pricing, as well as the ways you can build it into your business model.

What does cost plus pricing mean?

Cost plus pricing is often seen as the simplest way to calculate your service or product pricing. It considers the running costs of a service or product, and then adds a fixed percentage on top of that cost; the result is your selling price.

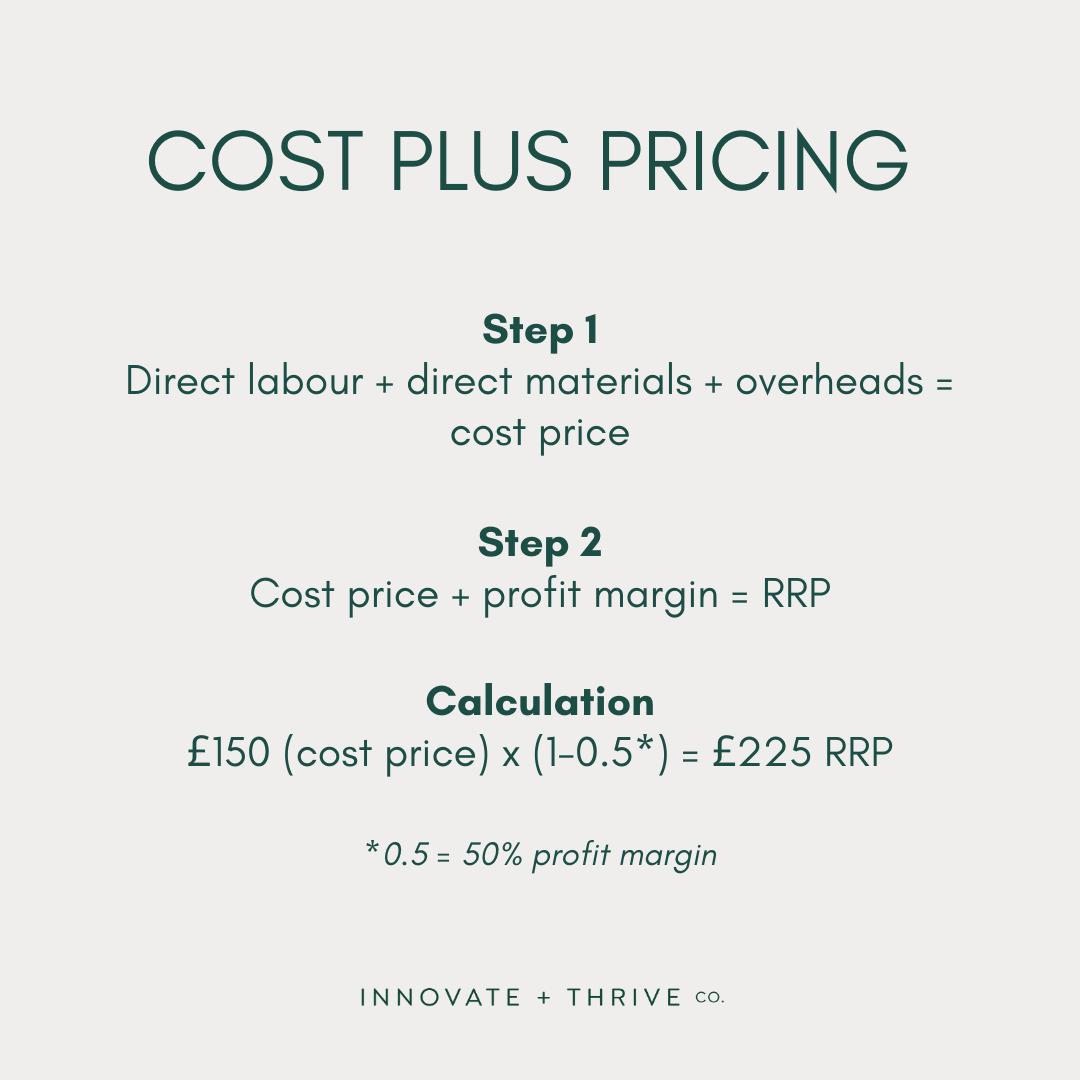

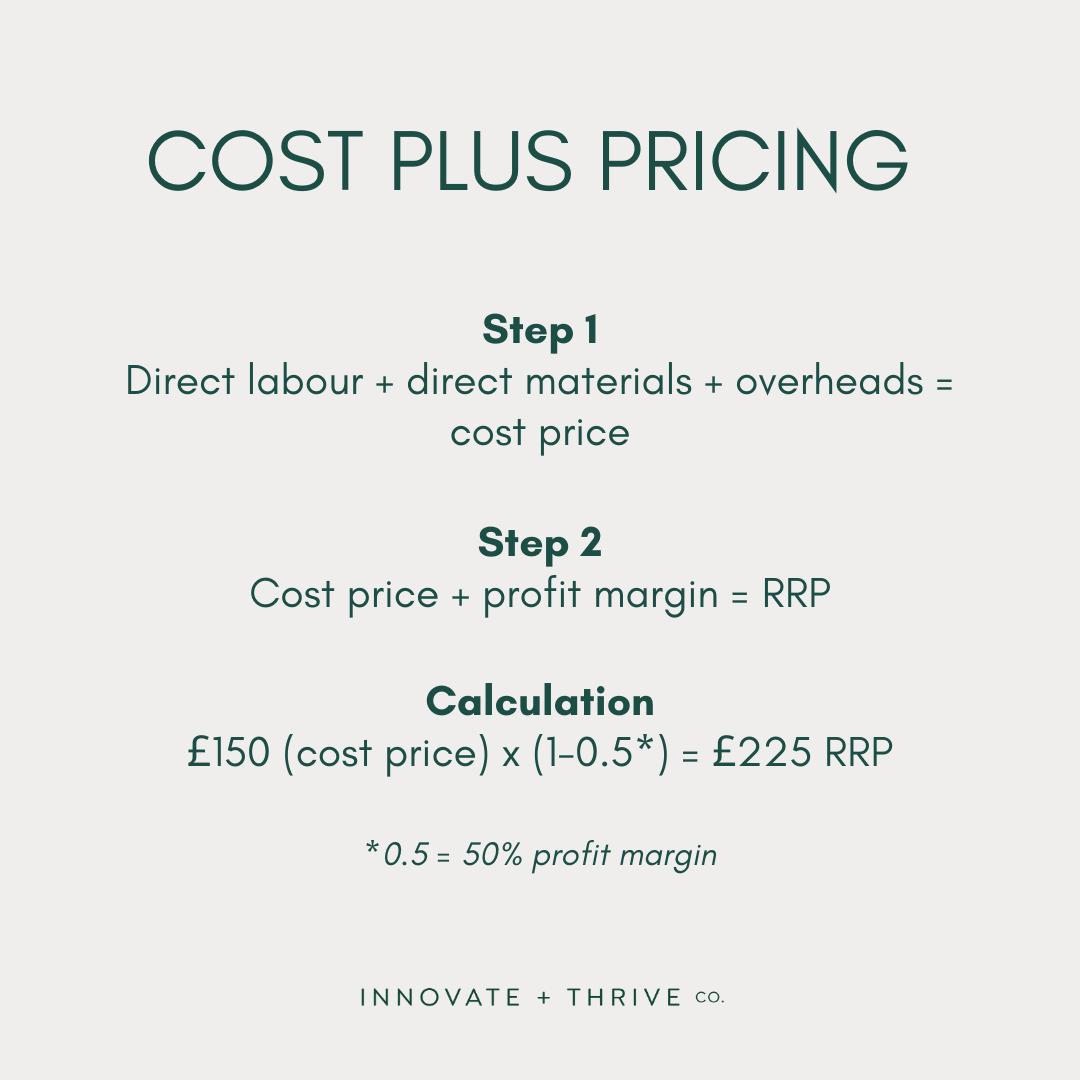

Running costs may include:

- Direct labour

- Direct materials

- Overheads

The markup is calculated by the seller, and it is the percentage difference between the unit or running cost and the selling price of the product or service.

For example, let’s say you’re a manufacturer of high-end laptop bags and you want to have a markup percentage of 50%. Perhaps the costs to produce one bag are:

- Direct labour (for example, the time it takes you and/or colleagues to produce the bag) – £80

- Direct materials (for example, the cost of the materials to make the bag) – £40

- Overheads (for example, the cost of any premises etc) – £30

These costs would culminate in a unit cost of £150 per bag. If we add a markup of 50%, the costs would look like:

Unit price £150 + 50% markup = £225 selling price

Simple, quick and profit centred. It’s no surprise really that it’s one of the most popular pricing structures, is it?

What are the advantages of using this method?

As mentioned, one of the huge draws of cost plus pricing is that it’s a real time saver; and let’s face it, when you’re a business owner, time is money.

It’s also super easy to figure out, which can be a bonus for anyone who hates the idea of copious spreadsheets and endless calculations. All you need to do is analyse your production costs and choose your markup percentage.

In addition, because you’re focusing on your running costs, cost plus pricing should ensure that all of your costs are consistently covered. This will enable you to enjoy a regular rate of return, thanks to your markup percentage.

It’s also easy to communicate to your customers and, as a result, a justifiable way to talk about your pricing. So, if you want to up your prices, you can share your new pricing structure in a fair, understandable way: your production costs have gone up by X%, and this means your selling cost has gone up by X%. No arguments (well, hopefully!).

What are the disadvantages of using this method?

On the other hand, while this method is undoubtedly one of the quickest ways to figure out how much you should charge for your services, it can also limit you and leave you with missed opportunities.

This is because cost plus pricing ignores the need for competitor analysis or customer research; this puts you at risk of over or underpricing your product or services, which could result in a loss of sales.

Another disadvantage of cost plus pricing is that it isn’t actually guaranteed to cover your costs. It’s easy to end up with an inaccurate estimate for your running costs, as well as your sales volume. If either are incorrect, and a lower markup is used to price the product or service, your costs to cover the product may not be covered. You could actually end up losing money.

Cost plus pricing has also been known to discourage production and business efficiency and cost containment. Naturally, you would think a business would aim to keep their running costs as low as possible. However, if your pricing system actually benefits from a bloated cost structure as a means of raising prices and increasing profit, chances are the business won’t ever try to lower their running costs. This can put a firm pin in the want to improve your operations efficiency… A sure fire way to stifle the growth potential of your business.

How is cost plus pricing calculated?

There are three simple steps for calculating cost plus pricing. These are:

- Determine the total cost of the product or service. This should be the sum of fixed and variable cost (fixed costs are the ones that do not vary by the number of units, while variable costs do).

- Divide this overall cost by the number of units so that you have the unit cost.

- Multiply the unit cost by the predefined markup percentage to give you the selling cost and the profit margin of the product.

If you aren’t confident on whether this is the right pricing structure for you, you can always book in one of my intensives; this is where we dig into the detail and lay the groundwork needed to transform your business.

Steph Sanderson is a business design consultant who helps service-based businesses to accelerate their growth in a sustainable way through pricing, customer experience, process planning, systems and strategic planning. She has over 15 years experience in the field, working as a business manager, global Change Manager and Implementation Specialist. Find out more.